Key Statistics from 2025

Attendees' Domains

- Final Decision Makers

- Evaluators

- Influencers

WFIS is a highly focused initiative that carefully cherry-picks key decision-making profiles from the Philippines' leading financial institutions that’re actively seeking cutting-edge solutions.

Over

84%

of attendees

had influence or sole responsibility in purchase decisions

BUDGET-BASED BIFURCATION OF DELEGATES

All delegates at WFIS 2025 - Philippines were pre-qualified based on their allocated budgets for the procurement of new solutions.

TIMELINE-BASED BIFURCATION OF DELEGATES

All delegates at WFIS 2025 - Philippines came with a pre-determined timeline for the procurement and implementation of new solutions. Here’s a quick representation.

months

months

months

The Philippines has entered 2026 as one of Southeast Asia’s most dynamic financial ecosystems, driven by strong public–private collaboration and a digital economy advancing towards $36 billion – getting further propelled by the country’s deepening internet penetration now at 83.8%.

At nearly $1 billion in 2025, fintech continues to bolster the nation’s growth by driving breakthrough innovations and attracting multi-million-dollar global investments. These indicators, together, attest to a sector that is maturing in scale, depth, and technological sophistication. To top it all, BSP’s National Strategy for Financial Inclusion 2022-2028 couldn’t have happened at a better time.

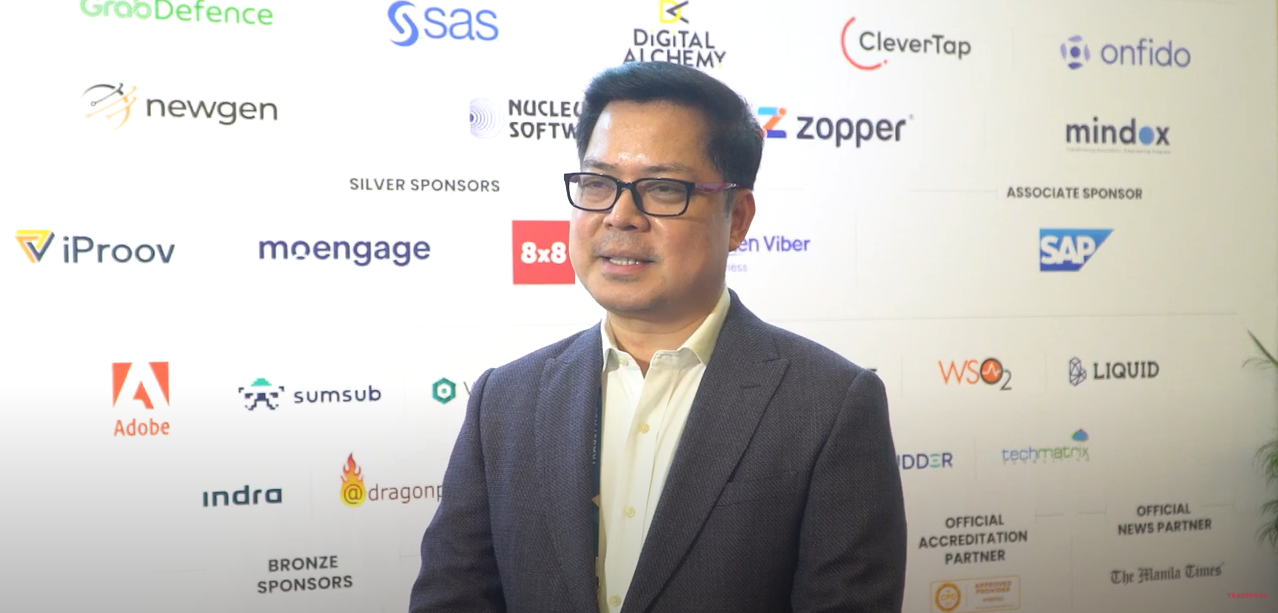

Giving a direct gateway to this thriving market, World Financial Innovation Series (WFIS) will return to the nation’s capital for its fifth edition on 25 – 26 August 2026.

Gearing up to host 600+ technology and business leaders from the country’s private and public sector – including top banks, insurance companies, micro-finance institutions, regulatory bodies, and government authorities – the upcoming edition will offer the most crucial platform for the Philippines’ financial stakeholders to connect, collaborate, and directly influence the future of finance in the country.

CONFERENCE

The conference is specifically tailored to bring out detailed discussions and expert insights on the most pressing industry topics.

It features the leading thought leaders who walk the attendees through their experience, share wisdom on the evolving trends and precisely project where the industry is heading.

EXHIBITION

The exhibition brings together the top organisations to the forefront and facilitates them in powering a cutting-edge showcase of their solutions. The organisations not only get a chance to pitch to the region’s biggest buyers but also get spectacular branding opportunities.

While the pre-qualified delegates get to explore a wide array of solutions, the platform aids the solution providers in leveraging the on-site technology for more impactful demonstrations.

AWARDS & GALA

The Awards & Gala program aims to recognize the leading talents who are driving remarkable innovations and excellence in the financial services industry.

Not only do the award winners get applauded by the entire industry but the whole session also gets complemented by a lavish dinner that presents a delectable spread of dishes and cocktails.

AFTER-HOURS

This session is specifically created for the attendees to break the ice at the platform and unwind amidst peers, industry leaders, and potential customers.

It makes great room for relaxed conversations and seamless networking in a positive setting alongside great spirit-lifting beverages and savory dishes.